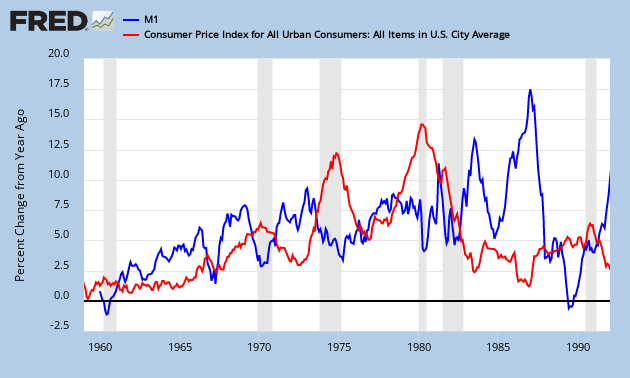

Even though empirical research casts doubt on the quantity theory of inflation, there has always been a strong correlation between the rate of money growth and the rate of price level changes within the US and also across OECD Countries. However, something seems to have changed since the early 1990s.

The first two charts show the relationship within the US and across OECD countries, between the rate of money growth and the rate of price changes.

However, when I look at what has happened since the early 1990s, the relationship is not so tight, nor even evident in the data at all!

Note that the data is sparse for the OECD, and that I also pulled out a couple of high inflation, high money growth outliers from each of the two charts (Mexico in the latter and Mexico and Turkey in the former).

So, does this mean we have entered into a new era of macroeconomics? Can central banks expand the money supply without consequence? I think not. I’d love to hear some theories as to what is going on. I’ll advance my own sometime later this week or month.

Last Friday I talked to a stockbroker, looking for bonds. (Believe it or not, for someone who just had 20M GMACS mature, his last.) The broker made a comment to the effect that the Fed was driving longer-term interest rates down, so today was the day to buy, since yields would be lower Monday.

My response to him was first that he did not know what the three-year Treasury rate would be on Monday nor does anyone else. I told him that the only rates the Fed can control absolutely is how much they can charge at the discount window, but they can’t affect longer rates too long.

I’m reminded too often of the days of Jimmy Carter, and to be bipartisan, Richard Nixon, when our central bank tried to play games with long-term rates, and failed. But my recollection is that the market has not always recognized the underlying long-term consequences of monetary misbehavior.

After 1969, you could buy AA-rated long-term corporate bonds yielding around 8%, which had been priced to yield 4% or less just ten years earlier. But then in 1979, you could buy similar bonds yielding 11%, roughly. This was roughly the same time they were making inflation jokes on Saturday Night Live.

Then you had supply-side tax cuts, the government stopped sinking its fangs, inflation came down, businesses prospered, and bond yields declined, but it was only in November, 1984, that they started to decline to recent levels. From 1994 to today, the market has behaved as if it expects inflation to be moderate.

I think there is always a lag between accelerating monetary growth and its consequences, and that is very dangerous to bet the ranch on something happening in the short term, one way or the other.

Why is this? Perhaps it is because everybody reads their own press releases, and spends the rest of the time reading and watching the financial press some of who are green MBA’s, or journalism majors ten years ago. Same people the broker I talked to on Friday listens to.

But the Chinese communists laughed at Tim Geithner today, worried whether their Treasurys will decline. Sure, they are not worried about default, since the Treasury runs the mint. I do not think even they think the laws of macroeconomics have been changed, and I don’t think they are amused by Saturday Night Live reruns either.

Proofing the above, I meant November 1994, not 1984.