Keynesian fiscal policy calls for stimulative government spending programs when private consumption sags and calls for a reduction of government spending when private economic activity is heating up. The joke on the people who are skeptical of government, but who are economic utilitarians nonetheless is that the latter rarely happens. For example, I’d get on the Krugman bandwagon for massive stimulus during recessions if he advocated for massive reductions in government spending during expansions. Of course that would never, ever happen in a million years. Any suggestion that the government pull back would be a “threat to the fragile expansion” and vital government services would be lost. Such is the forked tongue of the government religionists.

In any case, how has the Keynesian apparatus held up over time? I’d argue that rather than government spending stimulating during recessions and dampening during expansions, government spending has been a major source of instability. On its face this should not be all that surprising. By the time politicians get the data on private activity, and by the time the legislative process takes its course, the stage of the business cycle is almost certainly changing. In other words, the difficulty in obtaining just-in-time information and the long lags in the legislative process virtually guarantee that fiscal efforts to mitigate business cycle movements are like a drunk man groping in a closet for his lost keys.

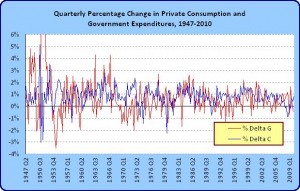

Below is some simple data to begin to make my point. The BEA reports on a quarterly basis total government spending, private consumption spending and private investment spending back to 1947. The chart shows the quarterly percentage change in government expenditures and private consumption expenditures. A chart showing the same data, but taking 4 quarter moving averages before computing the quarterly percentage changes is identical. If I added in private investment to the consumption data, the pictures would be indistinguishable as well.

A careful look at the chart would tell you virtually nothing. Sometimes it appears that government spending and private consumption move in the same direction, sometimes in opposite directions. In fact, of the 252 quarters this chart covers, in 64.3% of the cases, government spending and private spending move in the same direction. If I add in private investment, the share actually rises. The correlation of these percentage changes is -0.12 – a very small slightly negative correlation. In an ideal Keynesian world, while the correlations would not be -1, they should certainly be much closer to one than zero.

But what about the timing problem I mentioned above? Well, suppose you look at changes in government spending a quarter after a change in private spending? Then we should see more occurrences of these two moving in opposite directions, right? Of course you would be wrong. Looking at changes in G one quarter hence, we see government spending and private spending moving in the same direction in 65.5% of the cases and if we look at G two quarters hence, we see government spending and private spending moving in the same direction in 67.9% of the cases.

Now, you cannot argue that these changes are reflecting successful government policy because I am looking at whether or not the government itself responded to the observed private data in a way consistent with Keynesian policy. This is an extremely primitive “analysis” so don’t take it at much more than reflecting the simple idea that it is not likely that governments respond in the way they think they can and that if there is truth to what I depicted then what appears to be going on is that government spending seems to ramp up during economic good times and ramp down during bad times – precisely the opposite of Keynesian proscriptions, and certainly destabilizing if you take that theory seriously.

My view is that if in fact this data is correct, then the government is doing exactly the correct thing if it hopes to alter business cycles. Government spending extracts resources from the private sector, making us poorer. So we should “want” more of that during expansions. Similarly, we should want less of this wasteful activity during recessions.

There’s lots more to say – I hope this inspires a student to dig deeper into what is really going on.

Here is Robert Heilbroner on Keynes:

Keynes himself in a letter to the New York Times in 1934 wrote, ” I see the problem of recovery in the following light: How soon will normal business enterprise come to the rescue? On what scale, by which expedients, and for how long is abnormal government expenditure advisable in the meantime?

Note “abnormal.” Keynes did not see the government program as a permanent interference with the course of business (wintercow emphasis). He saw it as lending a helping hand to a system that had slipped and was struggling to regain its balance.

Good work, Wintercow. I only had time to read through it once, stopping by your graph and going to your point about its telling us nothing. Keynes is god to the progressives. I note Wintercow’s emphasis, and will endeavor to provide something empirical or theoretical. Meanwhile, I await comments from your followers, and perhaps your students who are brave enough to engage adults in ideas.

this may seem dumb, But I was in one of your classes about 2 or so years ago at rochester, did pretty terrible to be honest and ultimately ended up taking time off of school in general. Anyways, when I went to your lectures, I always got this feeling you had some serious underlying message you were trying to get across to your students. I was never able to figure it out exactly… Likely will never figure it out on my own, so I’ll pose this question: If you could sum up everything you want to tell the world in one or 2 sentences, what would you say?

this is one central concept i dont understand about keynesian policy. If such a multiplier does exist when the government redirects money in a recession (which im guessing is based on assumptions like animal spirits or the paradox of thrift and the liquidity of money) , wouldn’t it simply be logically conclusive to assume that, following the concept of a multiplier, government spending is simply more effective not only in a recession but always?

What the crux of the problem is to me is that all these keynesian assumptions and theories are inherently not counter-cyclical, becuase if a multiplier effect exists in government spending and stimuli during recession, then it should be logical also to advocate for a centrally planned economy because all government spending would, well, simply multiply.

Mark,

The multiplier argument hinges on there being excess capacity and latent demand during recessionary times that does not exist during expansions. So government spending will influence production and spending that would not otherwise be happening – or so it is told. Therefore during the expansions, government spending when there is full employment and production is at capacity is thought to be inflationary.

-Mike

Mark,

Your professor mildly leaves you to figure it out.

But think about it from a practical point of view: how can one possibly expect the government not to waste the money we send to them? Ever count the number of people with shovels along the road digging versus the number of people with shovels watching?

You might argue that these people are contractors, not direct employees of the government, but they are contractors paid by the government. Importantly, the government, not the Governor, not your congressman, not any official is spending his own money on this enterprise. They are spending someone else’s money to have six guys watch a seventh guy dig a hole somewhere that may or may not be useful.

Forget the multiplier. I would like to hear a plausable argument that any government spending has a greater value than 0.5.

The latest $800 billion stimulus mostly went to the states, who sorely needed the money to pay for all of their extra employees. OK, some of them were teachers who actually corrected their tests on time, but since we have tolerated illiteracy for three or four generations, isn’t it time to say “enough”?

I recommend a passage from Hayek quoted by your esteemed professor about the tinmaker, who decides at the moment about how best to use scarce resuorces. It is a lesson in epistimeology.