When economists calculate "optimal" taxation rates to correct various negative "externalities" they typically start from the assumption that the good in question is not taxed. So, for example, when we think about how much we need to tax activities that emit carbon dioxide, we start by asking the question of how much damage is done by each unit of carbon dioxide emitted (as if we really know) and then ask how much carbon this particular activity emits. Optimal tax rates are set to be equal to the damage that is expected to come from the emissions.

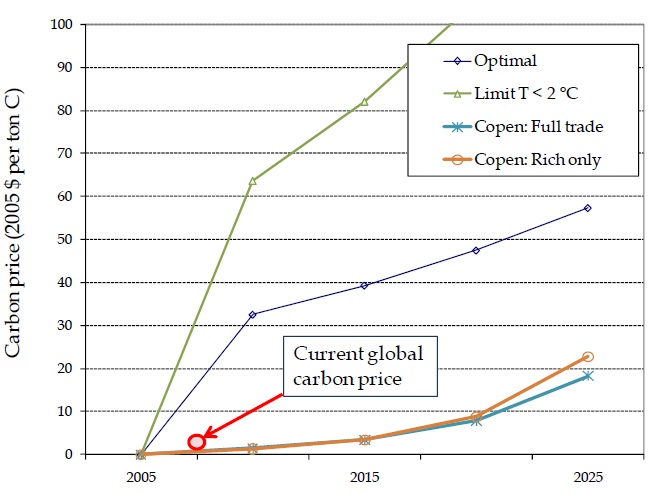

Seems pretty simple. And it is, in theory. Here is a recent paper by one of the leading economists who study the optimal global warming tax, William Nordhaus. The following chart illustrates what the tax rate on a ton of carbon should be (2005 prices) based on statistical models he has constructed for the global economy (don't laugh) and based on what the IPCC tells him the damages from carbon emissions would be:

It looks like the optimal carbon tax should be about $40 per ton of CO2 emitted right about now. Remember of course that there is lots of variation around this number. But this number assumes that activities which produce carbon have no taxes related to them already. But that is, to put it mildly, an understatement. We all pay income taxes, payroll taxes, etc. Sure, the activities that are tied to them may not generate much carbon, but the suppression of our income from those taxes reduces how much carbon we consume and produce. But remember that we have a plethora of sales, excise, use and other taxes that ARE directly tied to activities that produce carbon. Are there not sales taxes on cars? Are there not taxes and tolls for the use of some roads? And most important, we have this picture that I took a few weeks ago:

Hmmmmm, so gasoline in South Dakota where I snapped this picture already has a 42.4 cent per gallon tax tied to it. Let's see just how much carbon is emitted from burning a gallon of gas? The US government tells us that each gallon of gas burned releases 19.6 pounds of carbon dioxide – thus each gallon of gas burned releases 0.0098 tons of CO2 into the atmosphere. If each ton of CO2 causes $40 of damage then it must be the case that each 0.0098 tons of CO2 causes approximately 39.2 cents of damage.

If these calculations are close to correct, then an optimal gasoline tax to mitigate the worst of our worries related to global warming (i.e. to keep temperatures from increasing more than 2 degrees Celsius) would be 39.2 cents.

But look at the picture above.

I might have to remember this when it comes to writing testimony in the future. I think I'll have lots of fun with some of the natural gas posts later this year.

This may be a dumb question but if a gallon of gas weighs a little over 6 pounds how do I get 19 pounds of co2. I really don't understand chemistry but that seems weird.

Dan: combustion==oxidation. Burning 1 carbon atom bonds it to 2 oxygen atoms. The extra weight comes from atmospheric oxygen joining the gasoline’s carbon.

Wintercow: sales/use/VAT taxes don’t change relative prices, so do they still have the same Pigouvian effect that a specific excise tax would have? (Also see my other comment about our current excise tax only internalizing a rough approximation of miles driven on toll-free roads.)

The largest portion of the gas tax is an “excuse” tax meaning levied on that particular item.

EXCISE… Damn iPhone