It seems to be a lot!

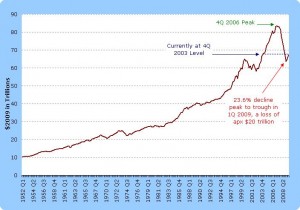

Since the the real value of household wealth hit is peak in the U.S. in the 4th quarter of 2006 through the trough in the first quarter of 2009, total U.S. household wealth (including real estate and equities) fell by 23.6% or about $20 trillion. The value of household assets has recovered a bit and is now at levels last seen in 2003.

House prices may be wealth, but they are not capital. They do not increase production in the future, just provide a stream of consumption. Additionally, no houses were physically destroyed by the collapse in valuation. Yes, the price of housing went down, but you can’t say that it is a clear negative for welfare. A lower price means less money for the seller, but a lower cost for the buyer. Additionally, lower real estate values mean less land taxes.