Regular readers probably are aware that I view public education as the single most appalling institution in America. As a result, we send our children to Catholic schools. While I do have some fondness for the type of education the Catholic schools supply, I probably hold the human embodiment of the Catholic church to be in the same league as public schools.

Nonetheless, given the unattractiveness (and cost) of other schooling choices, we choose to send the kids to Catholic schools. We have two children right now, and a conservative estimate of what this will cost us out of pocket over the next 14 years is about $12,000 per year (it turns out this really is a low-ball number). Since we are forced to pay school taxes despite our absolute dislike of that institution, our educational expenditures are truly the $12,000 per year, and not less. We have been, and continue to, save about $1,000 per month out of our paycheck to provide for the kids schooling (imagine how pleased I am to see my neighbors, with similar or larger incomes, send their kids to school in my dime, regularly flying off to trek around Australia, purchase property in the Adirondacks, drive clean, shiny, new cars, etc.). Imagine what you would do with an extra $1,000 in (after tax) income each month? New bicycles? No problem. New boat? No problem. Hiking trip across the country? No problem. Ski trip to Telluride? No problem. New clothes anytime you want them? No problem. Now don’t get me wrong, we are able to live what we think is a fairly comfortable existence, but we do go without these other sorts of things that we know we would love, and that our neighbors regularly enjoy.

But that is not really what we are giving up. We’d probably be saving that money for retirement, so we could enjoy a lot more of those things when we had the time. So how much is my dislike of public schooling really costing me? I think putting it in terms of how our beliefs increase the difficulty of achieving our retirement goals makes it easier to see.

Note, that these are not our only retirement contingencies. Some of our current income is being deferred to put my wife through school, and her additional future contributions to our family income in these calculations as assumed to be zero. Indeed, this is probably our most valuable “retirement” plan – keep that in mind when someone whines about savings rates being too low. I also am choosing a career path where I think I can work until longer than in other occupations, and I could work part-time right up until I meet my maker – this not only includes teaching, but also writing and various foundation and consulting activities. So I am not banking on any of that in these calculations either. My best guess is that between the accumulated savings from my wife’s income and my small amount of working while “retired” we would have at least twice as much for retirement as I show you below.

So what is our retirement goal? We basically think that we want our income not to fall when we decide to retire. Many financial advisors tell you that you don’t need to assume this, that you can get by on 60% of what you spend now. I don’t buy that for one bit. Our second goal is to be able to retire and live on the income generated by our nest egg alone. That’s another way of saying that we’d like to leave our savings for Amelia and Isaac (or their kids) or for a worthy charity or foundation upon our passing. Again, many retirement calculators assume something else – that you would eat into your principal so that when you die, you will have exactly $0 left. We do not wish to do such a thing. So again, our retirement goals are somewhat aggressive as compared to what you might expect.

What have we managed to stash away so for? Not much alas. My first pile of savings was entirely lost in the dot.com crash (I was a banker and thought I knew more than I did). We have paid off several debts, and our second pile of savings was lost in the housing crash. For example, we lost about $100,000 of equity in our home in Massachusetts when we sold it to take this current job in Rochester. Also, in what follows, we are placing a value of zero on any equity we have in our current home and any asset we currently own, which is far from true, but not an unreasonable thing to do for retirement planning (unless perhaps your goal is to sell everything at age 60 and live in a really cool RV, which we have considered!).

So, we have about $98,500 in our retirement account today after the beatings we have taken. And we save an additional $7,350 each year into that account (over 10% of our after-tax income, though in an ideal world we’d manage to triple that number). We invest in extremely low-cost funds via Vanguard (i.e. index funds) and use an aggressive asset allocation strategy, with about 90% of the portfolio invested in a diversified pool of equities, and the other 10% on debt instruments. Among the equities we are exposed to commodity and real estate. We don’t believe we can beat the market, or if we did, to have the time or interest to try to do it, so we follow the Fama-French strategy almost to a T. Historically since we have saved for retirement (probably the worst 14 year period to invest in US history) our portfolio has returned 4.5% annually (for example, the stock market has returned about ZERO percent from the day I drew my first real paycheck until today). So we will use this as our baseline expectation for future returns, although something like 7% would seem to be more reasonable.

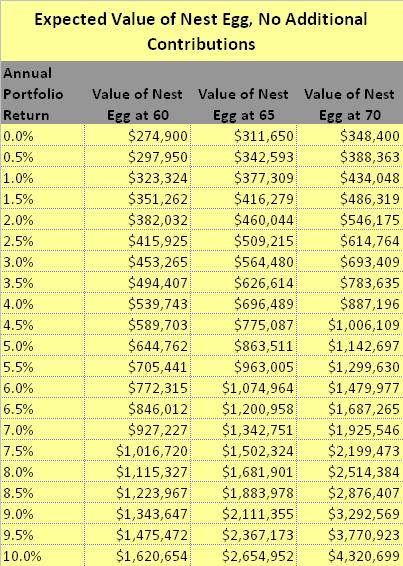

Based on our current behavior, what would our nest egg look like under different assumptions about our portfolio return, and about when I choose to stop working and saving? The first table below describes what would happen if none of our behavior changes – in other words, if we still send our kids to Catholic schools, and if we do not add a single penny to our retirement as our income and life situation changes over time. These are conservative assumptions.

We’d love to stop working at 60 but that is totally unrealistic. We put that in our calculations to capture a nice, “what if” scenario in the even of good returns or some other good fortune. The number we look at is how much we’d have for retirement at age 70 if our portfolio returns what it has during the worst investment period in recent history. And that gets our current nest egg up to $1 million. It sounds like a lot. But if we plan to live only on the income generated, and if we ignore tax distributions for the time being, if we take our nest egg and invest it in municipal bonds paying 5% per year, then this $1 million is equivalent to $50,000 of income tax free. After taxes, this is not orders of magnitude from what income we’d like to have, but it is certainly still less. Our ideal world would be for this number to be doubled.

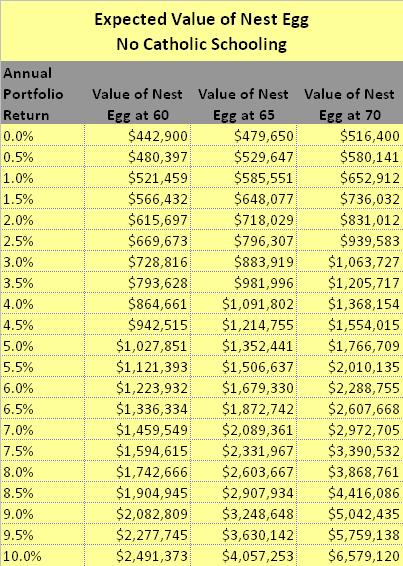

What if, instead of sending our kids to Catholic schools, we took that $12,000 we were spending for the next 14 years and added it to our current portfolio. Look at how the table would change.

At age 70, we’d have 50% more saved for our nest egg than before. Under the same assumptions, we’d be able to derive an income of about $78,000 per year (these are not taxable) from this nest egg. This WOULD in fact have us reach our retirement goals. $78,000 per year is more than our after-tax income of today, and we could earn that and not touch a single dime of the principal – leaving the kids each with three-quarters of a million or $1.55 million to a charity we love. There are several ways to think of the “cost” of our beliefs then.

- First is that our beliefs are costing us the ability to have the retirement that we would like to live. In fact, it reduces our retirement living standards by about 36% per year for all years that we remain retired.

- Second, you can argue that our dislike of public schools cost us nearly 10 years of our lives. If you compare the two tables above, you would see that if I took all $12,000 of Catholic tuition and put it in our retirement account, we’d have nearly the same nest egg at age 60 as we now expect to have at age 70.

- Third, focus instead on the kids. Suppose my retirement lifestyle is unimportant (I don’t think my kids will end up feeling this way), then you can simply ask how much of my kids’ future wealth am I sacrificing for MY belief? Indeed, when put this way, maybe I am being a selfish SOB. How the heck do I know that my kids would not have preferred a public school education but a lot larger bequest? I don’t. The difficulty with this view is that it assumes my kids have an ownership claim on me, which they do not, and it also assumes that I have no right to impress upon them views that are important to me. That all said, it seems like I am costing my kids about $550,000 (or $275,000 each) from forcing them into Catholic schools (assuming the educational quality is the same)

The post is already way too long, so I’ll stop it here thought there is much more to say. But keep these sorts of things in mind when thinking about your own retirement plans, and also when someone seems to hold beliefs. I do not accept someone’s belief when there is no cost to holding it, or at least if people are unwilling to recognize the possible costs. So, I’ve put my money where my mouth is, my dislike of public schooling has “forced” me to commit to work for a decade longer than I would have wanted to (as a rough estimate). Now, if I posed a question to people like, “What would I have to do to convince you to extend your working life for 10 more years” you can compare their answers to my actual behavior.

By the way, we are saving elsewhere, too, outside of this, but do not consider part of our retirement planning. We have life insurance that we plan to keep for some time now which is worth about $750,000. Elsewhere, we save $2,400 per year into our Health Savings Account that we expect to have to dedicate toward future health expenses when older. Nor do we count on receiving a single penny of Social Security when we retire since our prudence is likely going to mean we are going to be “means tested” out of the system when we get to that point. That’s ridiculous of course, since our average annual lifetime income is probably somewhere right at the median for all Americans. Maybe we should have sprung for that new boat or that fancy trip across Canada? Our kids may prefer that to getting any kind of a bequest!

I assume there is some significance in the fact that you did not mention tax deferred savings/investments? At least that’s how I interpreted “over 10% of our after-tax income.” I don’t know if that means that you choose to not participate or if you don’t think it is worthy of mention. But tax deferred savings is promoted by our government and ‘common wisdom’, as the road to security. No doubt it does change the equation when one considers leaving a legacy for one’s children.