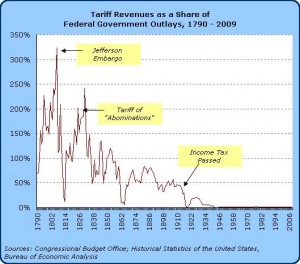

From the time of the Republic’s founding right up until World War I, the tariff (a tax on foreign goods and services sold in the United States) was the major funding source for the federal government. In fact, from 1790 through 1913 the median amount of federal expenditures financed via tariffs was 76%. In some periods, we collected more in customs duties than we spent out of the federal government. The chart below depicts this story, and continues it on through today.

What you notice is that after the passage of the income tax in 1913 customs duties have become a totally irrelevant way of raising revenues to fund government. Since the end of WWII, the median amount of government spending financed from tariffs is only 1.2%. Last year, only a half-percent of government spending came from tariff revenues.

To give you an idea of how much our federal government has grown through time, let us ask how large tariffs would have to be today in order to finance 75% of federal government outlays. In 2008, before the recession’s impacts were felt seriously by consumers, Americans imported about $2.5 trillion worth of goods and services from abroad. Customs duties on these transactions generated about $28 billion in revenues for the federal government. Thus, the average tax rate on foreign goods and services was roughly 1.1%. Prior to World War I, the average (median) tariff rate on imported goods and services was roughly 25% (23%).

Ignoring dynamic behavioral responses, how much income would we raise today if we raised tariffs from their current average of 1.1% all the way up to 25%?About $631 billion. How much is that? Well, in 2009, we spent $655 billion on the military. The total of all domestic discretionary outlays was $538 billion.Among nondisretionary spending items, we spent $678 billion on Social(ist) (In)Security, $500 billion on Medicare, $251 billion on Medicaid, $350 billion on welfare programs, and $512 billion on other retirement, disability and “other” nondiscretionary items.

In other words, if we financed the federal government the same way we did historically, then we basically would have to scrap every single dollar of non-discretionary spending that is going on in the government. Not reduce by a little, not reduce by a lot, but eliminate it entirely. Alternately, with the $631 billion in revenues from tariffs, it would mean that the government would be collecting about $840 billion in total revenues. If you wanted to have a military, then that leaves only $200 billion to spend on everything else – health, education, retirement, roads, welfare, etc. Even if you cut the military in half, that would leave only $500 billion for other programs. In other words, you could have a reasonable amount of national defense, and the entire Medicare system (with NO future growth) and then nothing at all beyond that.

We can look at the growth of government (this is federal, I am ignoring state and local growth mind you) in one of two ways. The first is to ask, how big would government be today if we raised revenues like we did during the tariff era? Second, we could ask, how big would tariffs have to grow to accommodate the current size of the U.S. government. Either way I present it, the growth of government is abominable.

Taking the first approach, if we kept taxes on imports at 25% (again, assuming incorrectly that the same amount of imports would be purchased when we raise their cost) and used this to fund 75% of the federal government, how large would the federal government be today? We imported $2.5 trillion of goods and services before the recession hit (last year we only imported $1.9 trillion). At 25%, the tariff would raise $625 billion of revenues for the government. If we assume that this represents 75% of the government’s total revenues, then in total the government would be able to spend $833 billion today. In other words, since the government spends $4 trillion today, the federal government is 4.8 times larger today than it was prior to World War I.

Taking the second approach, how large would tariffs have to be in order to finance the Progressive orgy that is happening right at this very moment? The federal government alone spent $4 trillion in 2009. And despite claims to the contrary that some of the stimulus will be withdrawn, don’t hold your breath. Students riot when they see tuition increase by a few hundred dollars. Do you really think unions and other government workers who have benefited greatly from stimulus are going to sit quietly when those perqs are withdrawn? In any case, the $4 trillion in spending is before the passage of new environmental and health care initiatives – and only in some alternative universe can anyone believe those things will be spending neutral, even if they are deficit neutral. Tariff rates would have to rise from the current 1.1% all the way up to 119% in order to finance three-quarters of that amount of government spending. And of course, this 119% tax would have to happen in a world where taxes do not discourage people from purchasing things.

To illustrate, suppose you can buy a Toyota Corolla for $20,000 today. There are virtually no customs duties on it. In tomorrow’s world, a Corolla (again, ignoring dynamic impacts on prices) would not cost you $20,000 but rather it would cost you $20,000 plus 119% of $20,000 in taxes – it would cost you $43,800. Progressives like to argue that people do not respond to higher taxes by spending less, they actually think that higher taxes make us all work more so that we can make enough money to buy the things you want. If that were true, then why don’t we tax incomes at 95% and raise tariffs to 1000%? Just think of how fast the economic recession would end!

The lesson of course is that no one in their right mind advocates 119% sales taxes and excise taxes and customs duties because of how crushing that would be to those markets and to consumers. And these people would be right. So how come when we tuck this 119% sales tax into dozens of other smaller taxes do people believe that it isn’t equally destructive? It is – unless the government thought up an efficient way of taxing people without changing their behavior. There actually is such a tax, it is called a head-tax. About the only things you can do to avoid paying it are moving to another country, or moving to another state of nature (i.e. death).

How large would this efficient tax have to be? There are about 120 million households in the U.S. So, if we taxed on a per household basis, then every single household would fork over $33,333 in cash on January 1st of every year – regardless of how rich or poor or what occupation or where you lived …

I’d note that trade flows as a function of GDP are not exactly at historical lows. The problem with raising revenues via tariffs has nothing to do with the volume of trade flows. The problem with raising revenues via tariffs is that, well, pretty soon there is nothing around to tax.

[…] Abominable Growth | The Unbroken Window […]

Alan Reynolds made a great point in today’s Journal about the way the world works. If anyone believes raising tax rates has a chance of paying for government spending folly, they should think again.